Hey traders and investors, are you ready to dive into the fascinating world of Bollinger Bands Narrowing and how it can signal opportunities in financial instruments? Strap in, because we’re about to explore a tool that can give you a leg up in the markets.

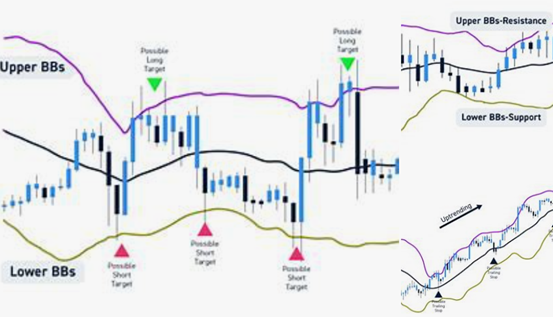

Let’s start with the basics. Bollinger Bands are a type of statistical chart characterized by a set of lines plotted two standard deviations (positively and negatively) away from a simple moving average (SMA). These bands are a staple in the toolkit of many traders, and for good reason—they offer a dynamic way to measure volatility and potential price movements in financial instruments.

The Art of Bollinger Bands Narrowing

Now, let’s talk about Bollinger Bands Narrowing (In Taiwan, it is called “布林通道變窄“). This phenomenon occurs when the upper and lower Bollinger Bands get closer to each other. It’s like watching a spring being compressed; the tighter they get, the more potential energy is stored, and the more significant the release can be. In the context of financial instruments, this narrowing can signal a period of low volatility, which often precedes a significant price movement.

Why Does Bollinger Bands Narrowing Matter?

You might be wondering why this narrowing of Bollinger Bands is such a big deal. Well, it matters because it can indicate a potential shift in market sentiment or a change in the underlying dynamics of a financial instrument. When the bands are narrow, it suggests that the market is in a period of consolidation, where the buyers and sellers are in a stalemate. This equilibrium can’t last forever, and when it breaks, it can lead to explosive moves in the price of the financial instrument.

Reading the Signs of Bollinger Bands Narrowing

So, how do you read the signs of Bollinger Bands Narrowing? It’s all about watching the behavior of the bands and the price action. If the price of a financial instrument is trading near the middle of the bands and the bands are getting narrower, it could be a sign that a breakout is imminent. Traders often look for a breakout above the upper band as a buy signal or below the lower band as a sell signal.

Bollinger Bands Narrowing and Market Timing

When it comes to timing the market, Bollinger Bands Narrowing can be your best friend. It’s not just about predicting the direction of the move; it’s also about timing your entry and exit points. By waiting for the bands to narrow and then expand, you can potentially catch the start of a new trend. This can be especially useful in volatile markets where prices can swing wildly.

The Role of Bollinger Bands Narrowing in Risk Management

Risk management is a crucial aspect of trading, and Bollinger Bands Narrowing can play a significant role in this. By identifying periods of low volatility, you can adjust your position sizes and set tighter stop-loss orders. This can help protect your capital during periods of high uncertainty.

Bollinger Bands Narrowing and False Signals

While Bollinger Bands Narrowing can be a powerful tool (In Taiwan, it is called “金融工具“), it’s not without its pitfalls. False signals can occur when the bands narrow but then widen without a significant price movement. To avoid these, traders often combine Bollinger Bands with other technical indicators, such as volume or moving average convergence/divergence (MACD), to confirm the signals.

Bollinger Bands Narrowing in Practice

Let’s put this into practice. Imagine you’re looking at a chart of a stock that has been range-bound for a few weeks. The Bollinger Bands are getting closer and closer together. Suddenly, the stock gaps up and breaks above the upper band on high volume. This could be a sign that the stock is ready to make a significant move to the upside.

Conclusion

In conclusion, Bollinger Bands Narrowing is a powerful tool for traders and investors alike. It can help you identify potential opportunities in financial instruments by signaling periods of low volatility that often precede significant price movements. Remember, though, that no single indicator is foolproof, and it’s always wise to use Bollinger Bands in conjunction with other tools and strategies to make well-informed trading decisions. So, the next time you see those bands getting cozy, keep an eye on them—they might just be signaling your next big trade.

Comments are closed.